How Much Mortgage Can I Qualify For?

Home Affordability: How Much Mortgage Can I Qualify For?

You’ve earned a pretty good credit score, and you’ve saved up for a down payment. But you still wonder: How much mortgage can I qualify for? The answer is complicated, and may take a lending professional to answer.

Click to see today’s rates (Aug 8th, 2017)

What’s My Comfort Zone?

Sure, you can look on those online mortgage calculators for initial information. But everyone’s situation can be quite different.

“The number one thing to remember is to never borrow more than you are comfortable paying every month, even if you can qualify for more,” says Beau Hodson, owner/senior mortgage originator at Transparent Mortgage in San Diego.

He says researching your own financial picture first, and then finding a lender who can guide you through every phase of a loan will help you get the perfect sized mortgage for your lifestyle.

What’s My Debt-To-Income Ratio?

Your debt-to-income ratio (DTI) is one of the most important considerations for mortgage lenders when they evaluate your application. The lender calculates this by adding your monthly bills and dividing that by your gross (before tax) income.

Monthly bills include the proposed mortgage payment, property taxes and insurance, car payments, credit cards and student loans (but not utilities or living expenses).

If your mortgage and other bills total $2,000, for example, and you earn $5,000 a month, your DTI equals 40 percent ($2,000 / $5,000 = .40).

“For most conventional products, the lender likes to see a ratio of 45 percent or below,” Hodson explains. “There are certain programs and alternative ‘automated underwriting’ platforms where we can try to get an approval if the ratios are a little higher than that.”

Can I Get A Mortgage With Higher DTI Ratios?

Your mortgage professional can determine whether a different loan product would be an option if your ratios are a little higher. There must be other compensating factors in the loan profile, like strong FICO scores, a big down payment or significant assets in the bank.

“I would say the two most important are credit score and debt-to-income ratio,” Hodson says. “This is why it is important to have a mortgage professional you trust who can quickly and accurately run these numbers for you.”

Are Online Affordability Calculators Completely Reliable?

Definitely not, Hodson explains. Qualifying for a mortgage includes a number of variables.

“And just like no two people have the same personality or set of circumstances, no two loan applications are exactly the same, “he says.

“That means there is always an element of technical expertise needed from a mortgage professional to put it all together. Without that, it would be like throwing darts at a board, very much hit or miss.”

However, mortgage calculators can give you a general idea of where you stand according to standard guidelines. Only you know if you can “push the envelope,” or if you should be more conservative.

What Are Homeownership Costs?

Homeownership costs go beyond principal and interest.

A homeowner should budget for the property taxes and property insurance, which are often added to the mortgage payment by the lender. This is called an “impound” or “escrow” account.

In addition, maintenance and repairs range between one and five percent of the property value each year. The amount depends on the property’s age and condition.

What Other Questions Should I Ask?

How much can I afford every month? Keep in mind your non-housing expenses, like child care, hobbies, savings goals, charitable contributions and commuting costs.

How long do I plan to live in this home? Shorter tenure means you can consider loans like3/1 and 5/1 ARMs. Those loans have lower rates fixed for three or five years, and that can make your home more affordable.

How much do I have for a down payment? The more you put down, the less you’ll have to borrow, and the lower your payment will be. However, it’s smart to have emergency savings in reserve. Don’t clean yourself out to buy a house.

Consider All Factors

“How much mortgage can I qualify for?” is just one aspect of homeownership. Other costs impact your decision.

“Many scenarios and options offer a trade-off between cash benefit and monthly payment. Striking the right balance between the two is important but also very subjective to the borrower and their financial situation,” Hodson says.

What Are Today’s Mortgage Rates?

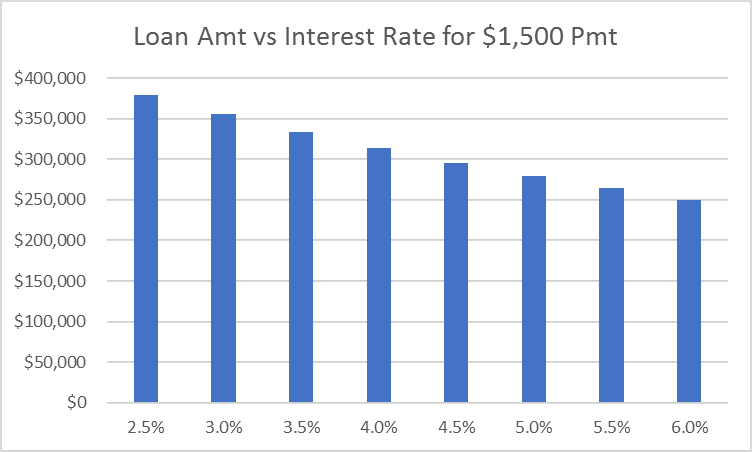

One of the biggest factor in homeownership is the mortgage rate you pay. The chart below shows how much you can borrow with a $1,500 principal and interest payment at different mortgage rates.

For this reason, it’s important to shop for the best mortgage rate and product you can find. Rates can vary between lenders by .25 to ,50 percent, and between mortgage programs by more than that.

Click to see today’s rates (Aug 8th, 2017)

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Try the Mortgage Calculator

Try the Mortgage Calculator